Insurance Industry

In the context of the full implementation of International Financial Reporting Standard 17 (IFRS 17), China’s Ministry of Finance introduced the “Chinese Accounting Standard No. 25—Insurance Contracts” (CAS 25) to further refine the national accounting standards system and align insurance contract regulations with international practices. Under the regulations, all insurance institutions operating domestically or listed overseas are required, within the specified timeframe, to carry out comprehensive adjustments to data, processes, and systems in line with the new standards, producing financial reports that meet the requirements. This process also facilitates a gradual transition toward business and financial management models aligned with the new standards.

In response to the implementation of IFRS 17 and CAS 25, Beiming Software has developed a New Insurance Contract Accounting Standards IFRS 17 (CAS 25) Platform Solution tailored for insurance companies. The platform is built on full-stack IT innovation technologies and utilizes a lakehouse integrated architecture, layered data and functional design, and distributed storage and computing frameworks. It consolidates data across all insurance business domains to produce financial reports compliant with IFRS 17 and CAS 25 standards. The platform effectively addresses technical challenges such as large-scale data model processing, full-process task monitoring, and data traceability. At the same time, it supports both financial reporting and operational analysis, providing data and application support for refined business operations management.

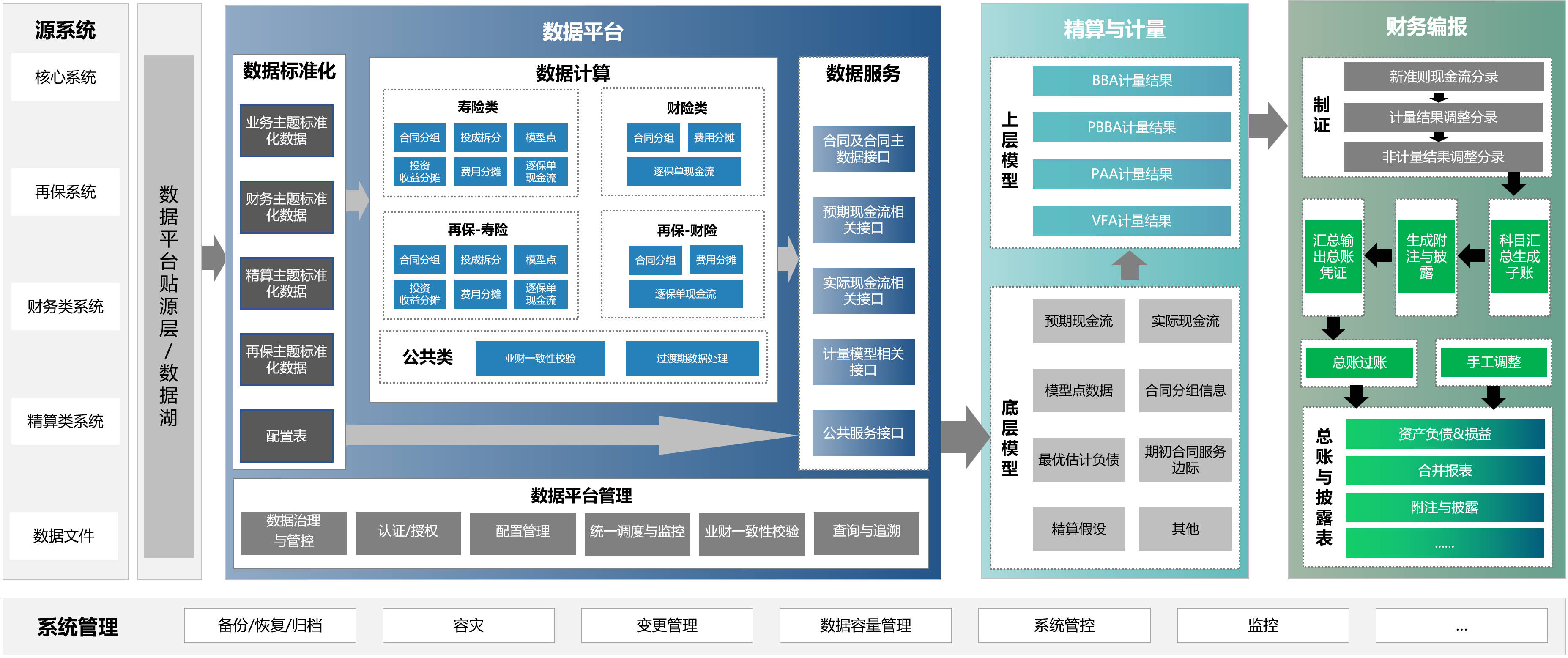

The New Insurance Contract Accounting Standards IFRS 17 (CAS 25) Platform uses automated workflows to produce financial statements and disclosure reports that comply with the new insurance contract accounting standards. The platform is organized into three main components: the Data Platform, the Measurement Platform, and the Accounting Engine.

The Data Platform manages the aggregation and preparation of foundational data, providing data support for the Measurement Platform and sub-ledger systems. The Measurement Platform receives model input data from the Data Platform and actuarial systems, performing core measurements based on different business types and measurement methods. It also supports flexible trial calculations, enabling core measurements at various business granularities. The Accounting Engine collects actual cash flow data from the Data Platform and combines it with the expected cash flow outputs from the Measurement Platform. It then generates accounting entries in accordance with the new standards, completes the finance-to-accounting conversion, produces sub-ledgers, and maps them to the general ledger.

Data Architecture Diagram

1. The Insurance Full-Domain Data Integration

Platform supports data integration with all relevant subsidiary systems under IFRS 17/CAS 25, including core, financial, and actuarial systems. The platform preprocesses input data and manages output for connected systems, performing data preprocess and transformation ahead of their business processes. The processed data is then returned to these systems, which include, but are not limited to, core business, actuarial, measurement, financial, and investment systems.

2.The platform ensures data accuracy and timeliness

in compliance with IFRS 17/CAS 25 standards, supporting both the financial reporting requirements of these standards and the data processing needs of enterprise management. This includes the design of IFRS17/CAS25-related data models, the calculations required for functionality, rule configuration, and data processing. The platform selects appropriate measurement models based on business type and product characteristics to perform major measurements. Within the Accounting Engine, the platform completes the generation from detailed ledgers to sub-ledgers, performs reconciliation between expected and actual cash flows, and ultimately generates the general ledger results. Additionally, the platform leverages a Hadoop and MPP storage and computing architecture to meet the timeliness requirements of month-end closing.

3.Data Quality Enhancement:

The platform performs data consistency checks based on IFRS 17/CAS 25 data flow diagrams, identifying validation nodes and the corresponding rules. After data processing is completed, verification procedures are executed and the results are recorded. Business users and operations personnel can access these results through the common capability platform to troubleshoot issues, improving the efficiency of data problem resolution and gradually enhancing overall data quality.

Currently, the New Insurance Contract Accounting Standards IFRS 17 (CAS 25) Platform has been fully deployed and launched in more than ten domestic and overseas subsidiaries of a leading insurance group, while implementation of the platform for several other insurance companies is steadily progressing. Beiming Software’s IFRS 17 (CAS 25) platform solution, as the first IT innovation solution introduced in China’s insurance industry for the new standards, was successfully selected in 2023 as part of the second batch of “Outstanding Financial IT Innovation Solutions” by the Financial IT Innovation Ecosystem Laboratory, which is led by the People’s Bank of China and organized by the China Financial Electronicization Corporation.