Financial industry

The Intelligent Risk Control and Decision Engine Solution leverages a proprietary smart risk management system to build an enterprise-level risk decision engine platform for commercial banks. The platform supports multiple credit business types and end-to-end risk identification and decision management across the entire lifecycle. It enables digital risk control decision-making for online businesses, hybrid online-offline operations, and traditional offline businesses throughout pre-loan, in-loan, and post-loan processes. By establishing centralized, bank-wide risk management, the solution enhances the market competitiveness of financial services and drives commercial banks toward deeper automation, intelligence, and comprehensive digital transformation.

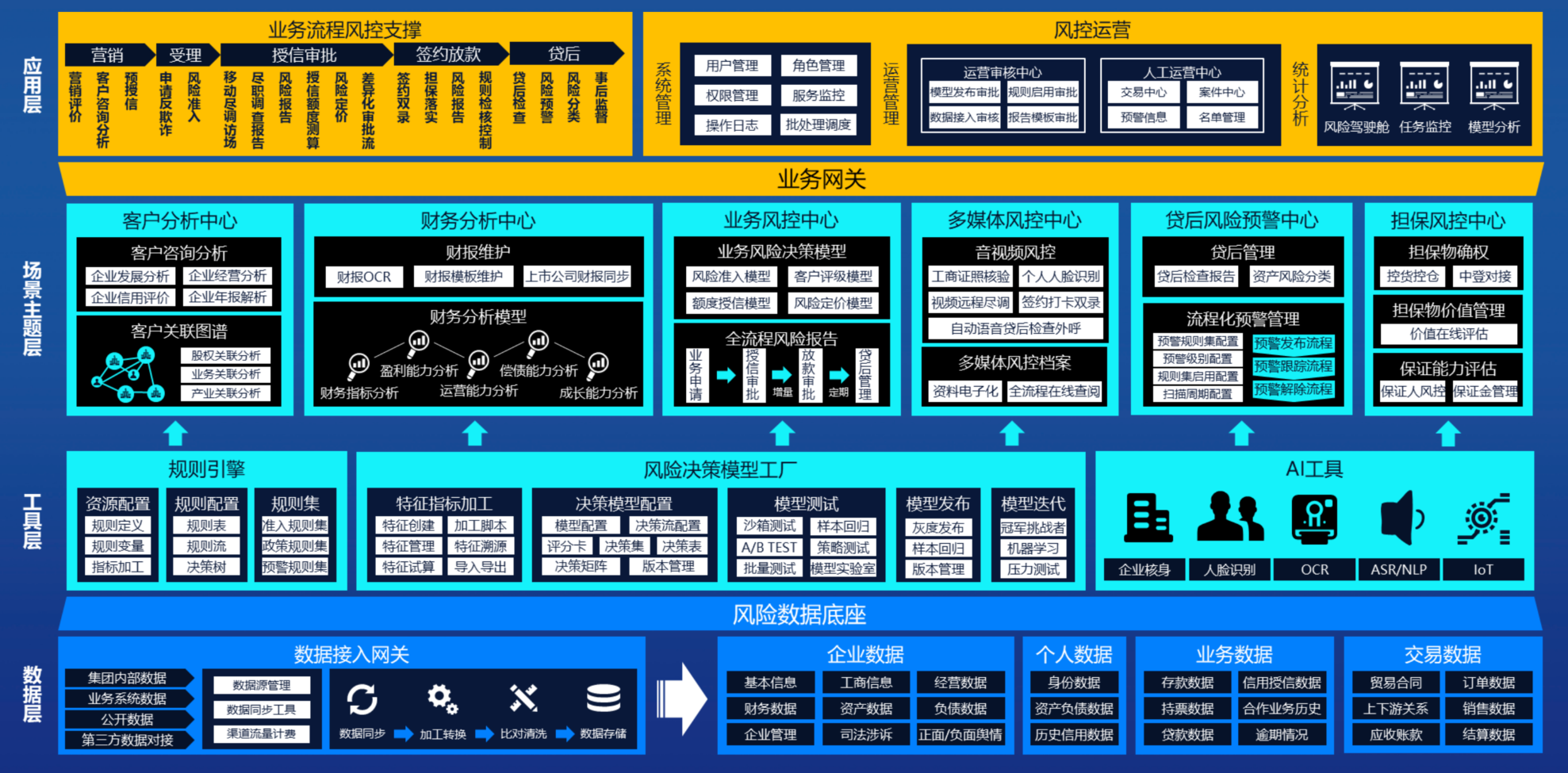

This solution covers external data integration→data visualization and query→data usage management→feature engineering→feature testing→feature management→feature repository usage→decision project management→a rich set of decision components→component template libraries→application and model visual development→model performance evaluation→model deployment and management→real time prediction service interfaces→batch scheduling services, and system administration. It enables standardized and digital construction of the decision engine platform, supports layered architecture with centralized management and shared reuse, allows visual configuration of strategies and full lifecycle management of models, and supports customized development to achieve integration with related business systems.

1. One Stop, Comprehensive Credit Risk Management: The Beiming Intelligent Risk Control System delivers end-to-end risk management covering risk identification, risk analysis, risk measurement, risk monitoring, and risk response, with full system functionality support. Data and risk control indicators define the upper limits of risk strategies. Built on mainstream external market data, the system maintains rich and comprehensive user data and risk indicators, enabling holistic risk assessment. The system supports configurable workflows for feature generation, component generation, strategy generation, sample generation, report generation, and alert rule generation. This ensures the efficient creation, implementation, and monitoring of risk control strategies.

2. High-Performance Proprietary Machine Learning Framework: The Beiming Intelligent Risk Control System integrates the company’s self-developed machine learning framework, delivering outstanding improvements in both model effectiveness and computational efficiency. The system supports industry-leading machine learning algorithms, including high-dimensional logistic regression, XGBoost, random forest, graph-based models, and unsupervised learning. With a user-friendly interactive interface aligned with banking user habits, it significantly lowers the barrier to use and greatly improves the efficiency of model development and optimization for risk control professionals.

3. Comprehensive Credit Risk Data Architecture: The Beiming Intelligent Risk Control System is a data-driven platform oriented toward inclusive finance credit operations. It establishes robust operational support capabilities and a comprehensive data architecture. Through full-spectrum monitoring and early warning across individuals, products, channels, marketing, risk control, and external information, the platform drives continuous optimization and enhancement of both business operations and risk management, meeting the increasingly high-frequency iteration demands of modern credit businesses.

4. Distributed Deployment with Flexible Scalability: The Beiming Intelligent Risk Control System adopts a distributed, virtualized microservices architecture. It enables dynamic and elastic scaling based on access traffic, supports rapid traffic distribution, and flexibly scales system concurrency. The system is capable of supporting loan volumes reaching hundreds of billions per year, efficiently addressing the performance challenges and future expansion needs of inclusive finance credit businesses at commercial banks. At the same time, the system employs clustered and virtualized deployment to ensure high availability. When a single node becomes unavailable due to failure or other reasons, the system can automatically switch to other nodes to continue providing uninterrupted services to customers.

In terms of strategy configuration capabilities, the system provides a visual interface to support the creation of rule components and the configuration of end to end strategy flows. Within the rule component creation module, the system offers six different configuration types to accommodate diverse risk decision logic requirements, including decision sets, decision tables, decision matrices, decision trees, scorecards, and risk authorization. Within the strategy flow configuration module, the system supports building the complete decision process for risk control events through a drag-and-drop canvas and supports champion-challenger components at the strategy flow node level. During the creation and configuration of rule components and strategy flows, the system supports online configuration testing, iterative version comparison and evaluation, shared reuse, and multidimensional monitoring and analysis. These capabilities provide strong assurance for banks in validating the online accuracy of rules and strategies and in ensuring effective management of iterative rule and strategy versions.

The system provides a modular management workflow that connects internal data silos. By leveraging massive, multidimensional data, it enables information integration, feature correlation, and business insights, unlocking data value and improving the efficiency of risk approval processes. The system establishes bank-wide unified risk data features and delivers standardized, comprehensive, and integrated risk data. This supports deeper data fusion and application, accelerating the online development of inclusive finance businesses for banks.

For external and third-party data sources, the system offers unified external data interface access, data collection, upload and import, internal distribution and invocation, visual query capabilities, and data quality monitoring. It separates underlying data access and processing operations, manages and derives underlying variables, and ensures the accuracy and stability of data at the source. Through this series of rigorous data monitoring capabilities, the system achieves comprehensive data management capabilities.

In terms of feature indicator management, the system supports configurable computation and management of different feature types across multiple data sources. This includes streaming feature computation based on real-time data, feature computation from internal bank databases, API-based feature computation, and complex derived features. The system also supports online testing of feature indicators to ensure the correctness and effectiveness of feature processing logic. In addition, to accelerate the rapid creation and application of similar feature indicators, the system provides feature variable templates, offering strong technical support for building a rich and scalable feature variable library.

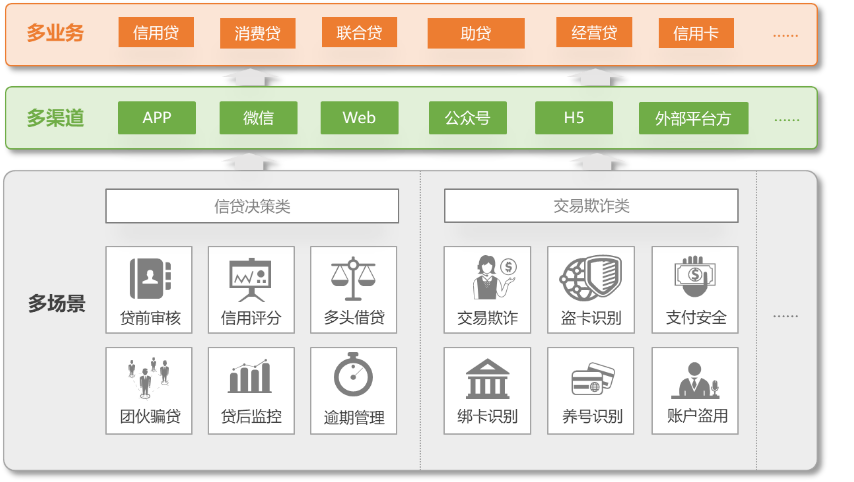

The Intelligent Risk Control System supports risk decision-making across multiple credit business models and credit product types. These include consumer loans, business loans, and secured loans under self-operated lending, joint lending, assisted lending, and pure traffic referral models. The system can rapidly handle risk decision requirements for various traffic channels and diverse credit assets, enabling banks to conduct internet-based credit businesses in a fast, flexible, and stable manner.

Beyond credit businesses, the system supports real-time anti-fraud capabilities across multiple financial transaction scenarios, including registration, login, account opening, and fund transfer. Supported transaction channels include mobile banking, online banking, POS terminals, and others, fully meeting banks’ requirements for accurate, fast, and real-time fraud interception in financial transaction services.

Langfang Bank Big Data Risk Control Platform